Mid-Term Years are Historically More Volatile

Mid-Term elections often determine control of congress and provide us an opportunity to either continue or change the course of our nation’s government. With mid-term elections for 2022 fading with the sunset, let’s take a brief look at what these half-time elections have meant for the markets and what they could mean moving forward.

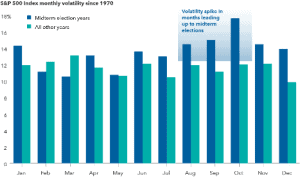

Increased Volatility

During mid-term election years, the S&P 500 Index tends to display heightened levels of volatility in the months leading up to the election (chart below). August, September, and October are the most volatile and tend to have larger percentage swings than other months.

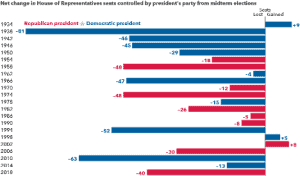

Sitting President’s Party Typically Loses Seats in the House

Dating back to 1934, the sitting President’s party tends to lose many House seats during mid-term elections.

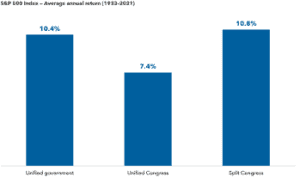

Markets Like a Government Gridlock

We often get the question, “What happens if the (insert party here) controls the government? The markets can’t like (insert sworn political enemy) running the show.” I know we have all said it and heard that question before! The answer is quite appealing to both sides… Since 1933, the S&P 500 Index average annual return has performed best in a split congress, followed by a unified government and a unified congress. Grid-lock means checks and balances keep one party or radical idea out of the foreseeable picture. The middle ground, sensible policy, prevails (or no new policy) depending on who submits the bill.

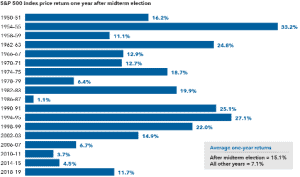

A look 1-Year Post Mid-Terms…

While past market performance does not constitute future returns, it can guide us on what we could expect depending on many different factors. Post-mid-terms, the S&P 500’s avg. 1-year return is 15.1%, compared to 7.1% in all other years.

In Conclusion…

While it looks like the government will be in gridlock, there are many factors regarding how the markets could perform over the coming year. With a recession here (in our opinion), geo-political risks rising, inflation, and an aggressive FED, we expect a state of volatility for the coming 12 months that favors “every day” stocks such as commodities, energy, healthcare, and consumer staples. Tech has taken a beating, but that does not mean they cannot rebound (once rates start to decrease and the economic forecast improves).

Please reach out with any questions, we are always here to assist in any way we can. Happy Thanksgiving to you and yours.

—

Important Disclosure:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that the strategies promoted will be successful.