In the world of investing, where trends come and go, there exists a timeless investment strategy that has withstood the test of time – dividend growth. Dividend growth investing revolves around investing in companies that consistently increase their dividend payouts over time. This strategy holds several distinct advantages that make it an attractive choice for investors seeking long-term wealth accumulation and stability. In this blog, we will delve into the reasons why dividend growth is a timeless investment strategy and explore its enduring advantages.

1. Consistent Income Stream:

One of the primary advantages of dividend growth investing is the consistently growing income stream it provides. By investing in companies with a track record of increasing dividends, investors can enjoy a reliable and growing stream of income. This income can serve as a regular cash flow for day-to-day expenses, reinvestment, or even provide a source of passive income during retirement. Dividend payments are typically more stable than stock prices, which can be subject to volatility, making dividend growth investments appealing for risk-averse investors.

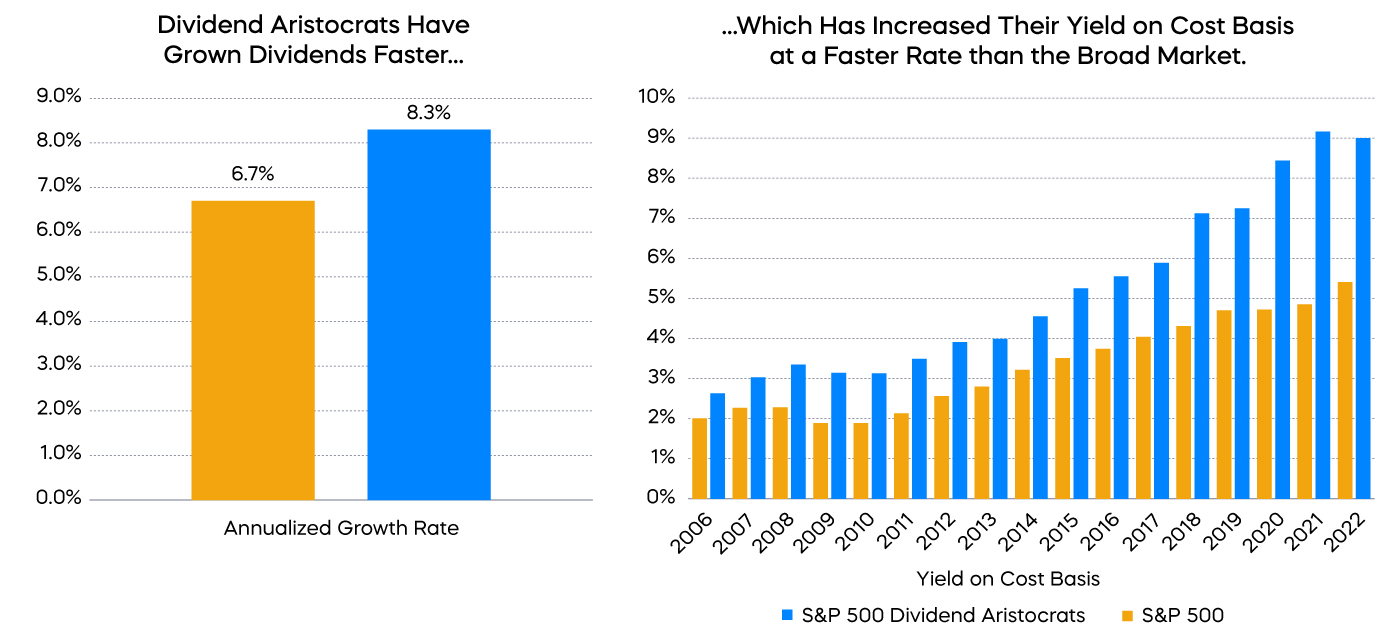

Source: Standard & Poor’s and ProShares calculation. 5/2/05 – 12/31/22. Yield on cost measures dividend yield based on the original purchase price of a stock, and it can grow significantly over time if a company regularly increases its dividend.

2. Long-Term Wealth Accumulation:

Dividend growth investing aligns perfectly with the goals of long-term wealth accumulation. By reinvesting dividends into additional shares of stock, investors can take advantage of the power of compounding. Over time, the compounding effect can significantly enhance the overall return on investment. The reinvested dividends purchase additional shares, which generate more dividends, leading to a cycle of ever-increasing income and wealth creation. This compounding effect, when sustained over the long run, can help investors achieve financial independence and reach their investment objectives.

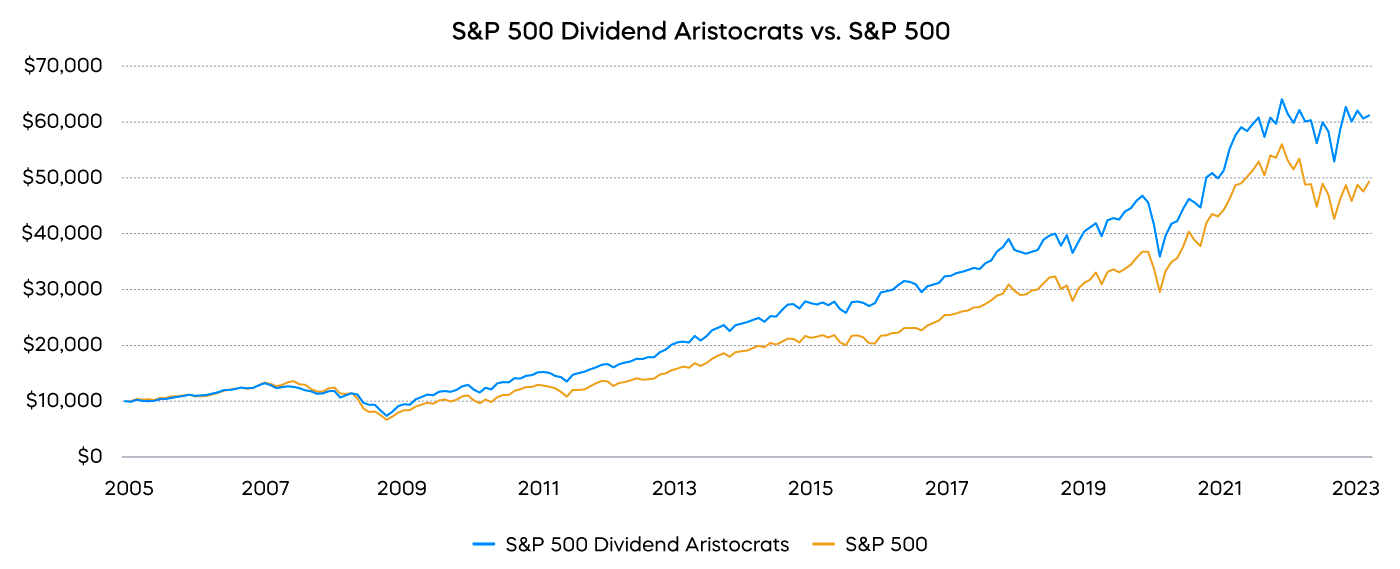

Sources: Bloomberg and Morningstar, 5/2/05 – 3/31/23. Since inception performance of the S&P 500 Dividend Aristocrats versus the S&P 500. The performance quoted represents past performance and does not guarantee future results. Index returns are for illustrative purposes only and do not represent fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index.

3. Potential for Capital Appreciation:

Contrary to popular belief, dividend growth investing is not just about the income it generates. Many companies that consistently increase dividends also have a strong underlying business and the potential for capital appreciation. In fact, dividend growth stocks have historically outperformed the broader market over the long term. Companies that prioritize dividend growth often have robust financials, stable cash flows, and a proven ability to adapt to changing market conditions. As a result, investors can benefit from both the income generated through dividends and the potential for capital gains as the stock price appreciates over time.

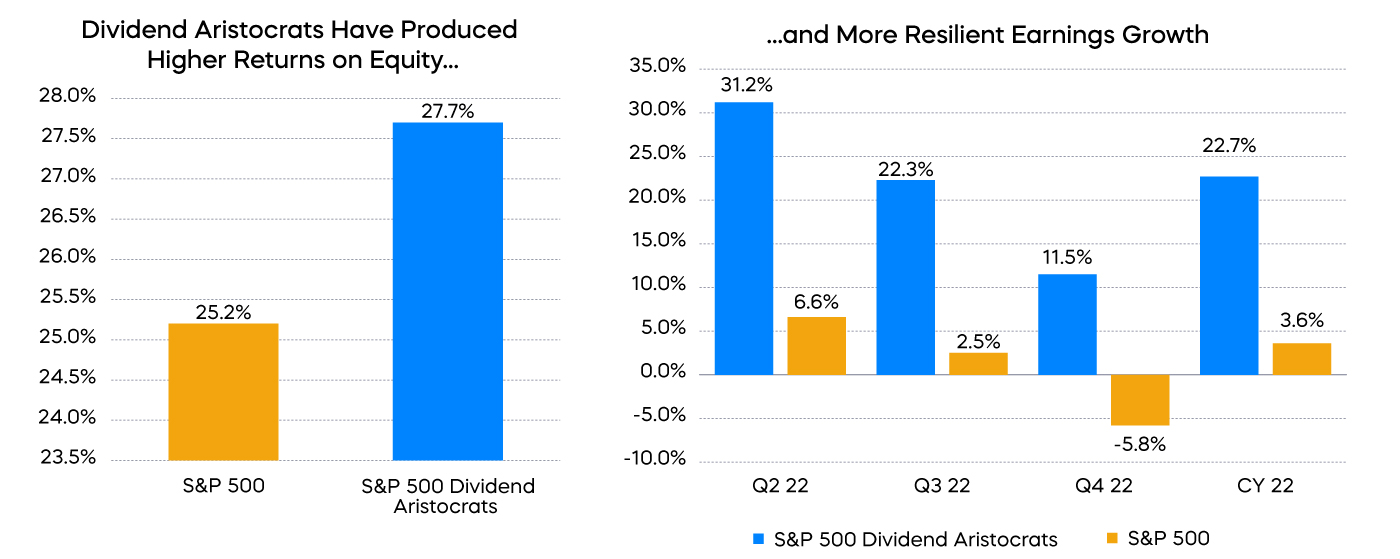

Source: FactSet, 3/1/22 – 4/20/23. Return on equity measures how efficiently a company generates profits and equals a company’s net income divided by shareholders’ equity. CY is defined as current calendar year. Index returns are for illustrative purposes only and do not represent fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index. Past performance does not guarantee future results.

4. Lower Risk and Volatility:

Investors seeking stability and lower risk in their investment portfolios can find solace in dividend growth investing. Dividend-paying companies tend to be more mature, established, and financially sound, with a history of weathering economic downturns and market turbulence. These companies often belong to defensive sectors such as utilities, consumer staples, and healthcare, which are known for their relatively stable performance during economic downturns. Dividends provide a cushion against short-term market volatility, as they continue to flow even when stock prices experience fluctuations. This stability can help mitigate risk and provide a more reliable source of returns, particularly during uncertain market conditions.

5. Inflation Hedge:

Inflation erodes the purchasing power of money over time, posing a challenge for investors. However, dividend growth investing offers an inherent inflation hedge. Companies that consistently increase their dividends tend to have strong cash flows and the ability to pass on increased costs to consumers. As a result, dividend growth investments provide an income stream that has the potential to keep pace with inflation. By choosing dividend growth stocks with a history of increasing payouts at a rate higher than inflation, investors can protect their purchasing power and ensure their wealth grows over the long term.

Conclusion:

Dividend growth investing has proven to be a timeless investment strategy with enduring advantages. Through its consistent income stream, potential for capital appreciation, lower risk and volatility, and ability to hedge against inflation, dividend growth investing offers investors a unique blend of stability and long-term wealth accumulation. By carefully selecting companies with a track record of increasing dividends, investors can build a robust and reliable income stream that can weather market fluctuations and contribute to their financial goals. As with any investment strategy, thorough research, diversification, and a long-term perspective are essential. Consider adding dividend growth stocks to your investment portfolio and unlock the enduring advantages of this timeless investment strategy.

—

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk, including the possible loss of principal.

Past performance is not indicative of future results.